Practice, supplier consolidations continue apace

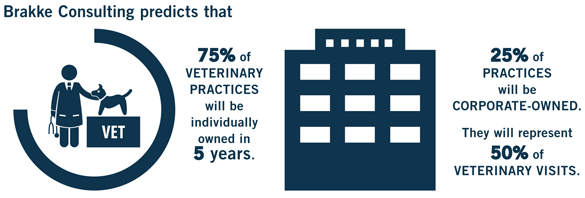

Twenty-five percent of veterinary practices, representing half of all veterinary visits, will be corporately owned in five years, according to a forecast from Brakke Consulting.

In the area of animal drugs, the top five manufacturers currently represent nearly two-thirds of the global market by revenues. Three veterinary distributors dominate the U.S. market.

Brakke also predicts that preventive care plans for pets will become the norm, with most major practice groups already offering such packages or planning to do so in the near future.

These statistics come from the "Hot Topics in Veterinary Practice" webinar, presented four times at the end of June by John Volk, Brakke senior consultant. The webinar also covered results of the Merck Animal Health Veterinary Wellbeing Study (see JAVMA, Feb. 15, 2018).

Volk said the drivers of consolidation include practices being attractive to investors, a retirement bubble among veterinarians, reduced demand by veterinarians to be owners, low interest rates, and the availability of staff veterinarians at a reasonable cost.

Mars, which owns the Banfield Pet Hospital and VCA chains, is approaching 2,000 practices. The next-largest practice groups are National Veterinary Associates, with more than 400 practices, and VetCor, with more than 200.

Volk said owners of practices with three or more veterinarians and average or above-average performance have many options when they want to sell. For those with $1.2 million-plus in annual revenues, the current prices are seven to eight times earnings before interest, taxes, depreciation, and amortization. He said, "I see a lot less stigma attached to corporate sale."

Brakke encourages associates to buy. Volk advises associates to work with a current owner, focus on good one- and two-doctor practices, and partner with others.

In drug manufacturing, the leading companies have characteristics such as broad product portfolios balanced between food and companion animals, diversification into new categories such as diagnostics, a propensity for acquisitions, large sales forces, and "expert, experienced" technical specialists. The largest companies are Zoetis, Boehringer Ingelheim, Merck, Elanco, and Bayer.

Among the implications of manufacturer concentration are a move to direct sales, a goal to offer one-stop shopping, integration into practice systems, and the expansion of services as well as products.

In veterinary distribution, small, state, and regional companies were numerous not that long ago. MWI Animal Health, Henry Schein, and Patterson Veterinary dominate the market today.

A battle is looming in veterinary distribution between veterinary and nonveterinary suppliers. Volk said, "That competition is really going to be on service and speed of delivery and not so much on price."

Regarding health plans for pets, Volk said pet owners want these packages, including the ability to pay for routine services in monthly installments. He said wellness plans increase veterinary visits and practice revenues, expand and improve patient care, attract new clients, and add "stickiness" to the practice-client relationship.

At NVA, visits by plan users increased 69 percent, from 3.3 to 5.5 times per year. Dental compliance increased from 8.4 percent to 74.4 percent.

Service providers can help practices implement plans, Volk said, while Partners for Healthy Pets offers a do-it-yourself manual at partnersforhealthypets.org.

Related JAVMA content:

Veterinarians Incorporated (March 1, 2017)

Mental health, well-being problem serious, not dire: study (Feb. 15, 2018)