Taking a multipronged approach to tackling educational debt

Dr. Anthony “Tony” Bartels has come up with a new veterinary diagnosis—“traumatic statement syndrome.” It affects veterinarians using income-based loan repayment plans. The onset happens two or three years after graduation as they start to see their educational loan balance growing because of accumulating interest, causing panic. “If we give it a name, maybe we can treat it,” he joked.

Dr. Bartels (Colorado State ’12) and his wife, Dr. Audra Fenimore (Colorado State ’09), are living with TSS. They hold $400,000 in combined educational debt. The couple manages it by using the Revised Pay As You Earn (REPAYE) Plan, paying a combined total of $930 a month, after switching from an income-based repayment plan. But finding a cure for the syndrome remains a confounding proposition, even for the brightest minds in the veterinary and economic professions.

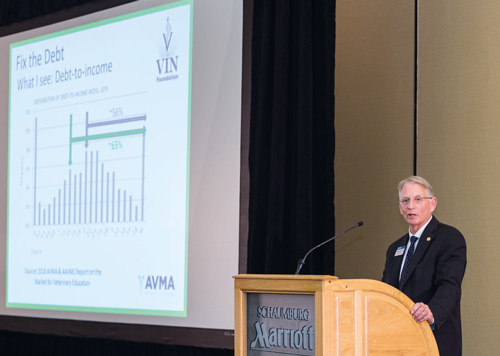

Dr. Bartels, of the Veterinary Information Network, was one of more than a dozen speakers at the fourth AVMA Economic Summit, held Oct. 24-25, 2016, in Schaumburg, Illinois. Around 175 people representing veterinary practices, veterinary colleges, and the veterinary industry, as well as volunteer leadership from the AVMA and Student AVMA, attended the event. The purpose of the annual meeting is to bring together thought leaders in veterinary economics and translate data into reliable economic resources for members, said Dr. Tom Meyer, AVMA president. Day one of the economic summit served as a follow-up to the Economics of Veterinary Medical Education Summit, or Fix the Debt summit, held this past spring at Michigan State University and co-hosted by MSU, the AVMA, and the Association of American Veterinary Medical Colleges (see JAVMA, June 15, 2016).

The Fix the Debt summit yielded a collective goal: to reduce the debt-to-income ratio of graduates of U.S. veterinary colleges from 2:1 to 1.4:1 by 2020. Michael R. Dicks, PhD, AVMA Veterinary Economics Division director, has estimated the latter ratio should position students to be able pay a relatively affordable 10 percent of their income, five years out, toward loan payments. At the summit, stakeholders had developed 10 recommendations to attain that goal, which included advocating for legislation to help reduce educational debt, minimizing the cost of borrowing, and enhancing student financial literacy.

Speakers at the recent economic summit gave updates, particularly debating how helpful financial literacy is and who should receive training, when.

State of flux

Fifty-six percent of 2015 veterinary graduates had a debt-to-income ratio higher than 2:1. Sixty-five percent of that class was above the Fix the Debt summit’s goal of 1.4:1, and 80 percent was above a 1:1 debt-to-income ratio, according to the 2016 AVMA & AAVMC Report on the Market for Veterinary Education. (These data cover graduates only of U.S. veterinary colleges, not of AVMA Council on Education–accredited foreign veterinary colleges.)

Borrowing is changing, and it continues to change. The traditional wisdom of ‘Pay as much as you can as fast as you can’ is not always the best advice. Education is key.

Dr. Anthony “Tony” Bartels, Veterinary Information Network

As a guide, Dr. Bartels says a debt-to-income that’s 1:1 or less is manageable, using traditional repayment plans. Anything between 1.2:1 and 2:1 is a gray zone that is highly dependent on circumstances. Anything 2:1 or higher should be managed through income-driven repayment plans, such as IBR, Pay as You Earn, and REPAYE.

The DIR for recent graduates will be difficult to reduce for a few reasons. Most importantly, more and more veterinary students are paying out-of-state tuition rates, often because veterinary colleges that add seats tend to add those instead of in-state positions, thus increasing the probability that students will borrow higher amounts. Also, while it’s good news that veterinary colleges are on a mission to grow their scholarship endowments (see JAVMA, June 15, 2016), they have a lot of work ahead. The mean endowment at U.S. veterinary colleges that reported data is currently $35 million; it was $22 million in 2010, said Dr. Andrew Maccabe, AAVMC CEO, citing the association's 2000-2015 internal reports. That said, the mean award for students remains around $2,800 and has even declined slightly in recent years.

“The problem with tuition is the average scholarship award is trending down because even though endowments are growing, so is total enrollment,” Dr. Maccabe said.

Dr. Bartels adds that the entire blame can't go to students for not budgeting appropriately. Tuition went up 35 percent while he was a student. Nationally, AAVMC data show that from 2000-2015 median annual tuition and fees at U.S. veterinary colleges for out-of-state students increased almost 120 percent, from $21,100 to $46,352, and in-state students have seen an increase of nearly 150 percent, from $9,085 to $22,448.

On top of this, borrowing and repayment terms aren’t static. For example, federal subsidized Stafford loans made between July 1, 2012, and July 1, 2014, accrued interest during the grace period. Further, recent interest rates have ranged from 5.31 to 7.9 percent. Finally, repayment options are evolving, and it’s hard to know which ones graduates qualify for or should use, he said.

“Borrowing is changing, and it continues to change. The traditional wisdom of ‘Pay as much as you can as fast as you can’ is not always the best advice. Education is key,” Dr. Bartels said.

Source: Association of American Veterinary Medical Colleges internal reports, 2000-2015

Promoting financial education

Veterinary students have taken to heart the notion of better educating themselves about debt and finances. The Student AVMA veterinary economics officer position, which the SAVMA House of Delegates made a permanent one in March 2014, is meant to ”promote veterinary students’ comprehensive understanding of basic financial and economic principles to become financially and economically literate graduates.” A focus last year was increasing student awareness of available loan repayment options.

SAVMA and its veterinary economics officer, Peter Czajkowski, worked with Dr. Bartels and the VIN Foundation to distribute basic introductions to major loan repayment programs used by most new graduates of AVMA Council on Education–accredited veterinary colleges. SAVMA also created a survey to determine awareness of the types of loan repayment resources available to veterinary students at each school (see JAVMA, June 15, 2016).

Czajkowski said the results showed that students at many veterinary colleges are not sure what resources are available to them. “Is this due to a lack of communication from the administrations at schools or lack of interest from students? Loan repayment options are too important of a topic for students to not be familiar with, especially where to find someone to help them,” he said.

SAVMA will conduct a follow-up study to figure out why students are largely unaware of the loan repayment resources available to them and compare what veterinary colleges already offer. “We’re also looking to answer, ‘Are you willing to prioritize learning about the available loan repayment options as highly as your veterinary curriculum?’” Czajkowski said. The hope is to present the findings at the next economic summit.

Getting the timing right

Not everyone agrees that increased financial education programming, particularly during veterinary college, is guaranteed to produce the desired results.

Lisa Greenhill, EdD, AAVMC associate executive director for institutional research and diversity, said applicants’ knowledge and use of financial products are consistent with those of other college-age students. Some applicants do appear to have a greater depth of knowledge, but even then, behaviors are largely unchanged; that is to say, increased financial literacy is not causally correlated with improved financial behaviors or decision making. Dr. Greenhill cited a 2014 paper, “Financial literacy, financial education, and downstream financial behaviors” (Manage Sci 2014; 60:1861-1883), in which the authors conclude: “We find that interventions to improve financial literacy explain only 0.1 percent of the variance in financial behaviors studied, with weaker effects in low-income samples. Like other education, financial education decays over time; even large interventions with many hours of instruction have negligible effects on behavior 20 months or more from the time of intervention.”

Dr. Greenhill says veterinary colleges must determine whether they should provide financial literacy programming and assess the ability of that programming to change behavior. “Applicants are not clamoring for this kind of programming. Awareness for desired programming occurs at matriculation,” Dr. Greenhill said. “There is also a need to assess the financial implications of the offerings and whether supporting services, such as having certified financial advisers on staff, will back literacy programming.”

In addition, she suggests institutions consider working with faculty from other disciplines and “ceasing undermining behaviors” such as requiring so many experiential hours from applicants, giving freebies and reduced-cost pet care to students, and encouraging good Samaritan saving of medically fragile animals.

Advocacy efforts

Dr. Maccabe focused on current advocacy and education efforts not only within veterinary academia but also among health professions nationwide to improve terms and conditions for federal student loans. The Association of American Medical College, for example, created its Financial Information, Resources, Services, and Tools program, available here, to provide reliable, free resources to help students and residents make better financial decisions.

The Ed to Med grassroots advocacy campaign, launched in January 2016 by the American Association of Colleges of Osteopathic Medicine, seeks to empower medical students, educators, and other advocates nationwide to raise the profile of graduate educational debt issues on Capitol Hill. The Ed to Med campaign website offers advocates tools and resources to share their educational debt stories, contact their elected officials, and educate their friends and colleagues on the issues facing medical and graduate students. The campaign launch comes in anticipation of an upcoming milestone for graduate student issues, the reauthorization of the Higher Education Act, the law governing federal financial aid and loan repayment options. The focus of the campaign for this year is to lower interest rate caps, reinstate the in-school interest subsidy, preserve Perkins and Grad Plus loans, reduce regulatory barriers, and maintain low interest rates on federal graduate and professional loans.

The AVMA Legislative Fly-in, being held April 23-25, will also focus on educational debt advocacy. More recently, nearly 140 letters were sent to lawmakers by veterinary advocates regarding educational debt, thanks to an AVMA Congressional Advocacy Network alert.

At press time, Dr. Maccabe anticipated that, by mid-December 2016, the AAVMC website would begin featuring further updates from the Fix the Debt summit as they happen. A Fix the Debt committee has formed and continues to identify people at the local, state, and national levels to champion the cause and, perhaps, find a cure for traumatic statement syndrome.

Related JAVMA content:

Fighting a market failure (June 15, 2016)

Debt summit moving into action phase (Oct. 15, 2016)

Tool details, compares cost of veterinary education (Nov. 15, 2016)

AVMA report gives specifics on student debt quandary (Dec. 15, 2015)